Pursuing Exemplary Business Management and Control

INDUS has been a proponent of SME-sector values and principles for more than three decades. The values of transparency, fairness and reliability and of ethical conduct in accordance with legal requirements play a decisive role in this. The conduct of the management and supervisory bodies of INDUS Holding AG is governed by the principles of good and responsible corporate governance geared toward long-term success. Efficient and trusting cooperation are just as important as transparent internal and external communication and protecting the shareholders’ interests. The Board of Management and Supervisory Board have thus for years followed German Corporate Governance Code recommendations. This provides suggestions for good and responsible corporate governance based on accepted national and international standards.

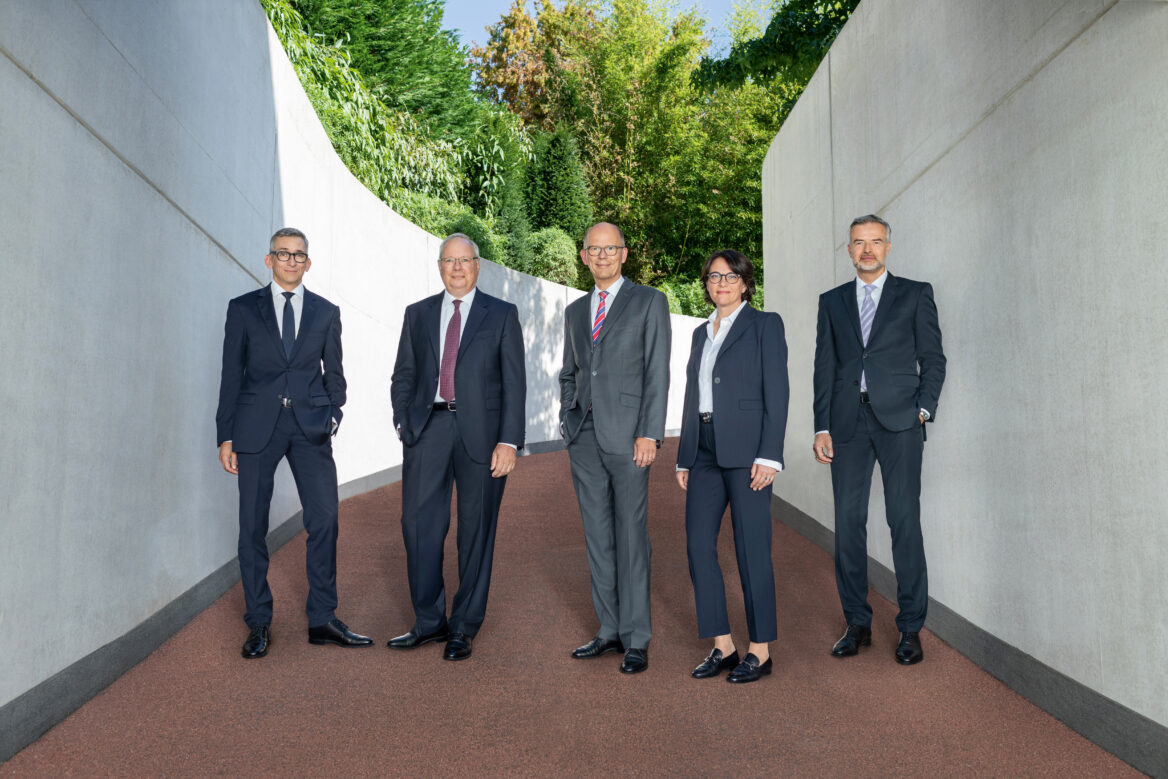

- Board of Management

The INDUS Holding AG Board of Management runs the company and manages its business activities. The Board determines the company’s strategic orientation, coordinates this with the Supervisory Board, and ensures its implementation. The Board of Management’s duties also include preparation of the quarterly, semi-annual, and annual financial statements of INDUS Holding AG and the INDUS Group. The Board of Management is comprised of five members. The Board’s members are Dr. Johannes Schmidt (CEO), Gudrun Degenhart, Dr. Jörn Großmann, Axel Meyer and Rudolf Weichert. The age limitation policy adopted by the Supervisory Board for members of the Board of Management, which provides for a termination of the mandate at the age of 67, is complied with.

The Board of Management compensation system was reviewed in 2009 and presented by the Supervisory Board at the 2010 Annual Shareholders’ Meeting. The revisions provide for a sustainability component as well. In accordance with legal requirements, the compensation system consists of three elements: fixed salary, short-term incentives and long-term incentives. Variable components comprise roughly 40% of compensation; components with a multi-year measurement base and short-term variable components are weighted accordingly.

Further details can be found in the compensation report of the current Annual Report.

- New Compensation System for the Board of Mangement

The new compensation system for the Board of Management was approved at the Annual General Meeting on May 26th 2021. You can find the Publication of the resolution and the system for the compensation of the members of the Board of Management here.

- Compensation Reports

The compensation report describes the compensation of the members of the Board of Management of INDUS Holding Aktiengesellschaft (hereinafter referred to as INDUS or the company) and the compensation of the members of the Supervisory Board. This compensation report is a report in accordance with section 162 of the German Stock Corporation Act (AktG) as amended by the Act Implementing the Share-holders’ Rights Directive (ARUG II). Furthermore, the recommendations of the German Corporate Governance Code (GCGC) and the requirements of the German Commercial Code (HGB) are followed.

Compensation Reports

Download ZIP

INDUS Compensation Report 2021(PDF, 2 MB)INDUS Compensation Report 2022(PDF, 974 KB)INDUS Compensation Report 2023(PDF, 1 MB) - Supervisory Board

The Supervisory Board of INDUS Holding AG appoints the Board of Management, provides guidance regarding company management and monitors management activities. Information on the focal points of Supervisory Board activity last year is available in the Supervisory Board’s report in the current Annual Report.

The Supervisory Board consists of twelve members. No member of the Supervisory Board performs or has performed executive, supervisory, or consulting functions at any significant competitors of INDUS. The Code recommendation is followed that no more than two former Board of Management members should be allowed on the Supervisory Board.

Supervisory Board compensation is governed by Section 16 (1) and (2) of the Articles of Incorporation. At the company’s extraordinary Annual Shareholders’ Meeting on November 29, 2018, the Articles of Incorporation were revised; this included, for the first time, the introduction of a fixed compensation for membership in Supervisory Board committees (excluding Mediation Committee).

Each member of the Supervisory Board receives compensation of EUR 30,000 and a meeting fee of EUR 3,000 per meeting, in addition to the reimbursement of expenses for his/her activities in the past financial year. The same applies for telephone and video conferences. The chairman receives twice the above two amounts, the deputy one and a half times. Members of the Supervisory Board who have not been members of the Supervisory Board during the entire financial year or who have held the chairmanship or the deputy chairmanship are only entitled to the remuneration pro rata temporis.

Each member of a Supervisory Board committee receives compensation in the amount of EUR 5,000 in addition to reimbursement of expenses for his/her activities in the past financial year. The chairman of the committee receives twice the amount mentioned above. Members of the committee who did not belong to the committee or chaired the committee for the entire financial year are only entitled to the compensation pro rata temporis. The aforementioned regulations do not apply to the committee pursuant to Section 27 (3) MitbestG.

Further details can be found in the compensation report of the current Annual Report.

The compensation of the Supervisory Board was confirmed by AGM resolution May 26, 2021.

The rules of procedure for the Supervisory Board can be found here.

- Financial Statement Auditing

Since the beginning of 2005, the consolidated financial statements have been prepared in compliance with International Financial Reporting Standards (IFRS). As before, the separate financial statements of INDUS Holding AG are prepared in accordance with the German Commercial Code (HGB).

The consolidated and separate financial statements for the 2022 financial year were audited by PricewaterhouseCoopers GmbH Wirtschaftsprüfungsgesellschaft, Frankfurt am Main. The corresponding statement of independence in accordance with Item 7.2.1 of the German Corporate Governance Code was obtained by the Supervisory Board.

The election of the Group Auditor 2023 can be found here.

- Risk Management

In compliance with industry standards and legal regulations, INDUS Holding AG has established a risk management system to identify potential risks and observe and assess these across all functional areas. As an integral part of business, planning, accounting and controlling processes, the risk management system is integrated into the INDUS Holding AG information and communications system, and is a key element in the management system. The structuring of the risk management system is the responsibility of the Board of Management, which ensures that risks are managed actively. The objective of the risk management system is to identify, take stock of, analyze, assess, manage and monitor risks systematically. The Board of Management regularly, and as required by events, examines and revises the company’s risk register.

The fundamentals of the risk management system include the organizational integration of opportunity and risk processes into everyday operations, an adequate management structure, a coordinated planning system and detailed reporting and information systems. Accordingly, the risk management system involves the portfolio companies submitting reports on the status of and changes in material risks affecting the holding company.

As a result, opportunities and risks are continuously reassessed by the INDUS Board of Management. Both company-specific and external events and developments are analyzed and evaluated in this process. Further details can be found in our Annual Report.

Internal control and risk management system based on consolidated and separate financial statement data

The scope and form of INDUS Holding AG’s accounting-related internal control system (ICS) are at the discretion of and the responsibility of the Board of Management. The Supervisory Board monitors the accounting process and the effectiveness of the ICS.

Internal control and risk management system - Statements and Articles of Incorporation

The Articles of Incorporation, Declaration on Corporate Governance and Code of Conduct of INDUS Holding AG reflect a business management governed by the principles of good and responsible corporate governance. Following the recommendations of the German Corporate Governance Code, the Board of Management and Supervisory Board jointly submit the statement of compliance required per Sec. 161 of the German Stock Corporation Act (AktG), made permanently available to shareholders via this website.

Documents

Download ZIP

Articles of Incorporation of INDUS Holding AG(PDF, 257 KB)Declaration of Conformity 2023(PDF, 42 KB)Declaration of Conformity 2022(PDF, 72 KB)Update Declaration of Conformity 2021(PDF, 401 KB)Declaration of Conformity 2021(PDF, 163 KB)Declaration of Conformity 2020(PDF, 38 KB)Declaration of Conformity 2019(PDF, 207 KB)Corporate Governance Report and Corporate Governance Statement 2023(PDF, 480 KB)Corporate Governance Report and Corporate Governance Statement 2022(PDF, 533 KB)Corporate Governance Report and Corporate Governance Statement 2021(PDF, 347 KB)Corporate Governance Report and Corporate Governance Statement 2020(PDF, 550 KB)Corporate Governance Report and Corporate Governance Statement 2019(PDF, 112 KB)Declaration on Corporate Governance 2018(PDF, 69 KB)Declaration on Corporate Governance 2017(PDF, 367 KB)Declaration on Corporate Governance 2016(PDF, 326 KB) - Code of Conduct

Compliance is much more than following laws and rules, but this is at least the basis for it. A consolidated compliance culture can protect the company as well as stakeholders, preserve its good reputation and thus becomes an important quality feature.

Documents

Download ZIP

INDUS Code of Conduct(PDF, 62 KB)INDUS declaration of principles on respecting human rights(PDF, 175 KB)Act on Corporate Due Diligence Obligations in Supply Chains (German only)(PDF, 384 KB)Code of Conduct for Suppliers and Subcontractors(PDF, 41 KB) - Disclosable Securities Transactions

Directors’ dealings in FY 2022

Notification dated June 30, 2022

Details of the person subject to the disclosure requirement: Dr. Jürgen Allerkamp

Function: Member of the Supervisory Board

Financial instrument: Share of INDUS Holding AG

ISIN: DE0006200108

Type of transaction: Purchase

Date: June 29, 2022

Price per share: EUR 23.1942

No. of items: 4.305

Total amount traded: EUR 99,851.00

Place: QuotrixNotification dated June 30, 2022

Details of the person subject to the disclosure requirement: Dr. Jürgen Allerkamp

Function: Member of the Supervisory Board

Financial instrument: Share of INDUS Holding AG

ISIN: DE0006200108

Type of transaction: Purchase

Date: June 28, 2022

Price per share: EUR 23.20

No. of items: 195

Total amount traded: EUR 4,524.00

Place: QuotrixNotification dated May 20, 2022

Details of the person subject to the disclosure requirement: Jürgen Abromeit

Function: Chairman of the Supervisory Board

Financial instrument: Share of INDUS Holding AG

ISIN: DE0006200108

Type of transaction: Purchase

Date: May 20, 2022

Price per share: EUR 27.1936

No. of items: 1,500

Total amount traded: EUR 40,790.45

Place: XetraNotification dated May 12, 2022

Details of the person subject to the disclosure requirement: Jürgen Abromeit

Function: Chairman of the Supervisory Board

Financial instrument: Share of INDUS Holding AG

ISIN: DE0006200108

Type of transaction: Purchase

Date: May 12, 2022

Price per share: EUR 27.4921

No. of items: 2,000

Total amount traded: EUR 54,984.25

Place: XetraNotification dated May 12, 2022

Details of the person subject to the disclosure requirement: Dr. Johannes Schmidt

Function: Chairman of the Board of Management

Financial instrument: Share of INDUS Holding AG

ISIN: DE0006200108

Type of transaction: Purchase

Date: May 12, 2022

Price per share: EUR 27.6464

No. of items: 3,000

Total amount traded: EUR 82,939.10

Place: XetraDirectors’ dealings in FY 2020

Notification dated March 31, 2020

Details of the person subject to the disclosure requirement: Dr. Johannes Schmidt

Function: Chairman of the Board of Management

Financial instrument: Share of INDUS Holding AG

ISIN: DE0006200108

Type of transaction: Purchase

Date: March 30, 2020

Price per share: EUR 23.4387

No. of items: 3,200

Total amount traded: EUR 75,004.00

Place: TradegateNotification dated March 31, 2020

Details of the person subject to the disclosure requirement: Jürgen Abromeit

Function: Chairman of the Supervisory Board

Financial instrument: Share of INDUS Holding AG

ISIN: DE0006200108

Type of transaction: Purchase

Date: March 30, 2020

Price per share: EUR 23.1225

No. of items: 3,500

Total amount traded: EUR 80,928.85

Place: XetraDirectors’ dealings in FY 2017

Notification dated July 5, 2017

Details of the person subject to the disclosure requirement: Dr. Jürgen Allerkamp

Function: Member of the Supervisory Board

Financial instrument: Share of INDUS Holding AG

ISIN: DE0006200108

Type of transaction: Disposal

Date: July 4, 2017

Price per share: EUR 61.80

No. of items: 4,000

Total amount traded: EUR 247,200

Place: HanoverDirectors’ dealings in FY 2015

Notification dated August 26, 2015

Details of the person subject to the disclosure requirement: Rudolf Weichert

Function: Board of Management

Financial instrument: Share of INDUS Holding AG

ISIN: DE0006200108

Type of transaction: Purchase

Date: August 26, 2015

Price per share: EUR 40.50

No. of items: 5000

Total amount traded: EUR 20,251

Place: QuotrixDirectors’ dealings in FY 2015

Notification dated August 26, 2015

Details of the person subject to the disclosure requirement: Dr. Johannes Schmidt

Function: Board of Management

Financial instrument: Share of INDUS Holding AG

ISIN: DE0006200108

Type of transaction: Purchase

Date: August 20, 2015

Price per share: EUR 43.92

No. of items: 500

Total amount traded: EUR 21,960

Place: XetraDirectors’ dealings in FY 2015

Notification dated August 26, 2015

Details of the person subject to the disclosure requirement: Jürgen Abromeit

Function: Chairman of the Board of Management

Financial instrument: Share of INDUS Holding AG

ISIN: DE0006200108

Type of transaction: Purchase

Date: August 19, 2015

Price per share: EUR 43.46

No. of items: 1,000

Total amount traded: EUR 43,461

Place: Frankfurt/XetraDirectors’ dealings in FY 2013

Notification dated December 4, 2013

Details of the person subject to the disclosure requirement: Jürgen Abromeit

Function: Chairman of the Board of Management

Financial instrument: Share of INDUS Holding AG

ISIN: DE0006200108

Type of transaction: Purchase

Date: December 4, 2013

Price per share: EUR 27.87

No. of items: 2,000

Total amount traded: EUR 55,740

Place: Frankfurt/XetraDirectors’ dealings in FY 2012

Notification dated October 2, 2012

Details of the person subject to the disclosure requirement: Dr. Jürgen Allerkamp

Function: Member of the Supervisory Board

Financial instrument: Share of INDUS Holding AG

ISIN: DE0006200108

Type of transaction: Purchase

Date: September 26, 2012

Price per share: EUR 18.77

No. of items: 4,000

Total amount traded: EUR 75,074

Place: OTC - SpeakUp for reports

Sustainable commerce provides the basis for positive future prospects for the environment, society and the economy, as well as each individual employee or business partner of INDUS (the group parent company).

The cornerstones of the culture of INDUS are the distribution of the key requirements and their independent implementation and management in the subsidiary companies, as well as a shared understanding of values and the minimisation of risks for a sustainable corporate development.

The “SpeakUp” reporting system creates additional trust and security on the basis of a clearly defined structure for the reporting and the escalation process which is accessible to everyone, thereby ensuring the sustainable success of the group and averting damage.

Public channels are also available. In Germany, the legislator generally provides for the priority of an internal report.

Here you will find the privacy information for whistleblowers and parties involved.

SpeakUp for reportsSpeakUp documents

Download ZIP

SpeakUp Guide(PDF, 265 KB)SpeakUp FAQs(PDF, 332 KB)