INDUS – We are shaping the future with SMEs

We buy and develop “hidden champions” with a clear technological focus.

INDUS is one of the leading specialists in the field of sustainable investment and development in the German-speaking SME sector. We acquire mostly owner-managed companies from the industrial technology sector and assist them in setting a long-term trajectory for their entrepreneurial development.

In our support, we always ensure that our portfolio companies are able to retain their particular strength, especially their medium-sized identity. In the best case scenario, the company’s former owners remain as managing directors of the company during the transition phase.

Through our continuous portfolio expansion, we improve the Group’s development prospects. This results in a high level of diversification in the Group’s portfolio. With their core capabilities the companies occupy interesting market niches for their industries, in which they have a leading position.

With the segment structure introduced on January 1, 2023, consisting of the three core segments ENGINEERING, INFRASTRUCTURE and MATERIALS, we are mapping the strengths and industrial expertise of the INDUS portfolio even better. We derive the future topics relevant to us from megatrends such as Sustainability, Digitalization, Mobility and Urbanization, and Demographics and Health.

We classify topics such as Energy Efficiency, Recycling and Waste Management, and Energy Technology under Sustainability.

In the area of Digitalization, topics in the area of Telecommunications Infrastructure, Automation and Robotics, Sensor and Measurement Technology and Logistics are particularly relevant for us.

Mobility and Urbanization is mainly found in the INFRASTRUCTURE segment and includes projects around supply networks and supply for Infrastructure Structures such as traffic routes.

Demographics and Health is mainly found in the MATERIALS segment, here among other things in the area of Medical Consumables and Aids, but also in the area of Wear Technology for field processing.

Our portfolio companies develop their business operations independently.

Our Group consists of INDUS Holding AG, the holding company based in Bergisch Gladbach, and the individual portfolio companies. Our direct subsidiaries have their registered seats in Germany and Switzerland.

Our portfolio companies have proven themselves to be “hidden champions” and have shown that they have mastered their business, which is why they are part of the Group. We therefore allow them the greatest possible operational autonomy. With our own know-how, we support them in making good things even better and in maintaining their performance.

As the parent company, we see ourselves as a strategic sparring partner for our portfolio companies from within the holding company. We perform central administrative functions as part of portfolio management. The members of the Board of Management responsible for segment management provide specialist support for their segment companies, develop their strategic alignment with a focus on future issues, and secure their earnings and value development. In continuous dialog with the management teams and supported by the central functions in the holding company, they ensure that our interests as shareholders are safeguarded.

Our performance pledge: Binding

We are offering our shareholders profit-oriented investment with prospects of value rises in the long term.

To our portfolio companies, we are an active sparring partner supporting them in their growth with capital, experience and expertise.

To our partners we are a reliable constant – fair in business dealings, predictable in collaboration and constructive in alignment.

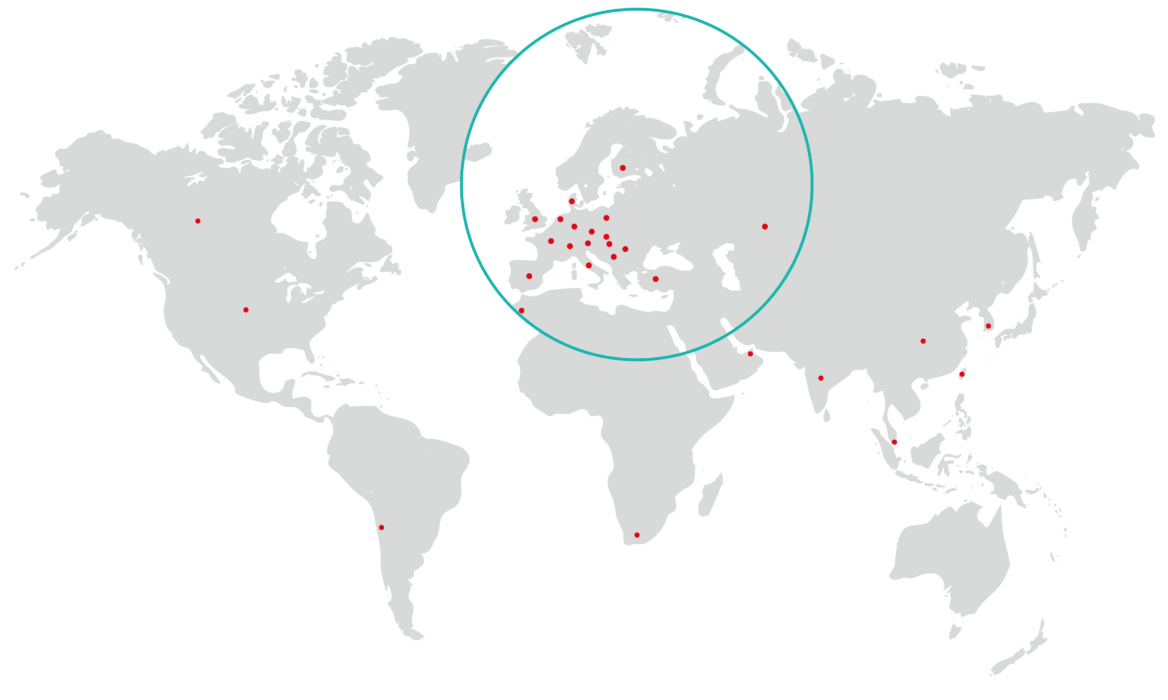

Our portfolio companies: On site in around 30 countries

Our recipe for success – buy, hold & develop

Over the past several decades, INDUS has built up a diversified portfolio by acquiring around 45 small and medium-sized “hidden champions.” We ensure growth and stable earnings with our sustainable corporate strategy. Our principle of “buy, hold & develop” ensures that we maintain a long-term investment approach. We also take the accelerated pace of change in the current economic environment into account via our segment management and offer our companies the exact resources they need to successfully grow their businesses even under dynamic conditions.