Current status at INDUS

Acting sustainably is deeply rooted in INDUS’ DNA and therefore also in its corporate strategy. In the M&A process, INDUS has integrated the assessment of a target company’s sustainability performance into the due diligence process for several years now.

INDUS published its first voluntary sustainability report for the 2016 financial year. Since 2021, progress in the company’s sustainability performance has been reported annually in the Separate Non-Financial Group Report. For the 2021 financial year, INDUS also applied the EU Taxonomy Regulation for the first time and identified taxonomy-eligible economic activities. In 2021, the Board of Management remuneration system was also expanded to include a sustainability component in line with ARUG II. A new Strategy and ESG Committee was established on the Supervisory Board in 2023.

INDUS has transferred the successful model of the innovation development bank to a sustainability development bank. Since 2022, this sustainability development bank has been supporting projects that further improve the sustainability performance of the portfolio companies. With the PARKOUR perform strategy update, the topic of sustainability has also moved further into focus in the relevant future fields for future acquisitions.

Our ISS rating enabled us to issue an ESG-linked promissory note for the third time in 2023.

Since 1 January 2023, INDUS Holding AG has been subject to the Act on Corporate Due Diligence Obligations in Supply Chains, which aims to protect human rights worldwide. It obliges companies to create transparency in their supply chain and to assume responsibility for the protection of human rights in their supply chain.

In the 2024 financial year, we will implement the rules of the CSRD Directive for the first time. This will also place the topic of social sustainability increasingly at the centre of our sustainability activities.

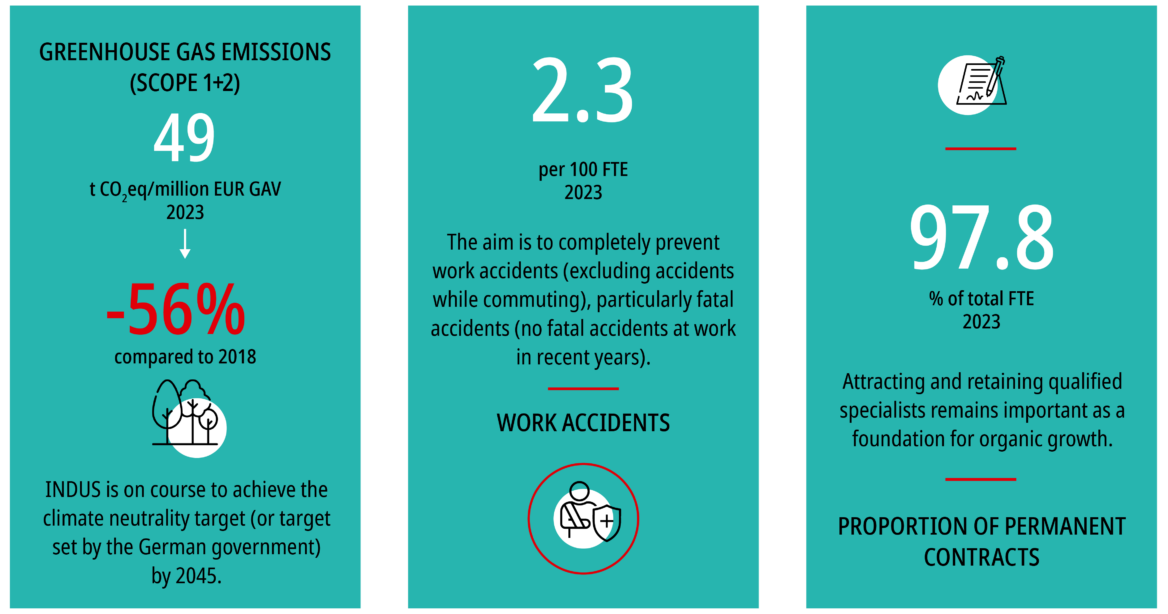

Key figures at a glance

Further key figures can be found in the nonfinancial report starting on page 19.

Recognition of our sustainability performance

INDUS was audited by renowned rating agencies. In the independent sustainability rating by Institutional Shareholder Services Inc., INDUS Holding AG achieved prime status in 2023 for the eighth time in a row In the international comparison group “Multi-Sector Holdings”, INDUS achieved the transparency level “Very High” and the overall rating “C+”. The assessment of “Corporate ESG Performance” is based on around 100 sustainability criteria from the areas of environment, social affairs and governance, which are specifically adapted to the starting position of the respective comparative industry.

MSCI: THE USE BY INDUS OF ANY MSCI ESG RESEARCH LLC OR ITS AFFILIATES (“MSCI”) DATA, AND THE USE OF MSCI LOGOS, TRADEMARKS, SERVICE MARKS OR INDEX NAMES HEREIN, DO NOT CONSTITUTE A SPONSORSHIP, ENDORSEMENT, RECOMMENDATION, OR PROMOTION OF INDUS BY MSCI. MSCI SERVICES AND DATA ARE THE PROPERTY OF MSCI OR ITS INFORMATION PROVIDERS, AND ARE PROVIDED ‘AS-IS’ AND WITHOUT WARRANTY. MSCI NAMES AND LOGOS ARE TRADEMARKS OR SERVICE MARKS OF MSCI.

Always one step ahead

- 2016

Voluntary submission of first non-financial declaration & materiality analysis for the Group.

- 2017

More in-depth data in the non-financial declaration, external stakeholder dialogue.

- 2018

Qualitative consequences of climate-related effects according to TCFD (internal stakeholder perspective, managing directors surveyed).

- 2019

Group-wide energy audit carried out again, suppliers and customers of the portfolio companies surveyed by TU Dortmund.

- 2020

First ESG-linked promissory note, capital market sustainability survey sent out, change to accounting approach for Scope 1 and Scope 2 emissions with inclusion of portfolio companies.

- 2021

SUSTA[IN] is the first sustainability magazine to appear online.

- 2022

Fourth strategic initiative “Striving for Sustainability”, launch of the Sustainability Promotion Bank and publication of second SUSTA[IN] magazine.

- 2023

Establishment of a group-wide system to map the requirements of the Supply Chain Act and publication of the third SUSTA[IN] magazine.

- 2024

Implementation of the CSRD Directive planned and publication of the forth SUSTA[IN] magazine.

INDUS’ contribution to the Sustainable Development Goals (SDGs)

The foundations of INDUS’ sustainability strategy are summarised in five principles. These refer directly to the Sustainable Development Goals of the United Nations Global Compact (UN GC). The interrelationship is shown in the chart below. You can find out more in the non-financial report starting on page 22.

INDUS action areas

INDUS has translated the five principles into a total of six fields of action:

(i) Protection the environment

(ii) Fair work

(iii) Social justice

(iv) Human rights

(v) Honest business

(vi) Shareholder support

The regular performance of materiality analyses helps to identify and prioritise the most important sustainability issues for the company. By identifying the material sustainability issues, INDUS creates a basis for the INDUS Group’s sustainability activities and the focal points of the sustainability strategy.

Questions can be addressed to sustainability@indus.de or directly to: