Looking for: Highly specialized and future-oriented small and medium-sized industrial technology companies

Growth industries

We are looking for economically successful and future-oriented industrial technology companies from German-speaking medium-sized businesses.

Their business model is viable and has the potential for strategic further development.

Their development is driven by the future topics we have identified as relevant for INDUS.

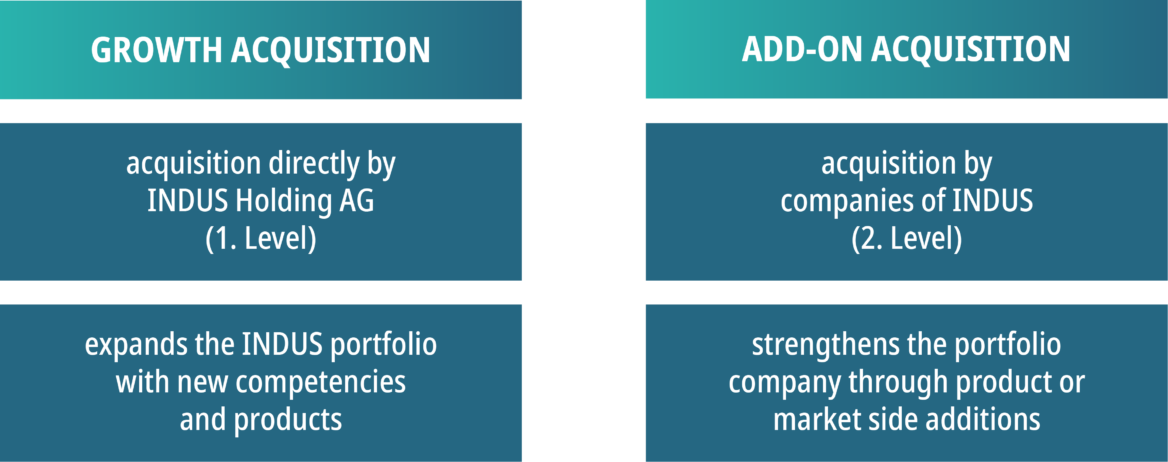

The companies we add to the Group either directly expand our segments or strengthen our segment companies on a second level.

Investment criteria for growth acquisitions

- Sales: 20 – 100 million EUR

- Double digit EBIT margin

- Equity rate > 30 %

- Cash flow orientation

- Low level/ no liabilities to banks

- Broadly diversified customer base

- Niche position

- Own industrial added value

- Growth perspectives, also internationally

Criteria for the acquisition of add-on acquisitions

In the area of complementary acquisitions, the strategic fit with our existing portfolio companies is decisive. This is characterised in particular by complementary products, an expansion of the company’s presence or the creation of industrial focus areas within a segment. Also decisive are the economic potentials that result from a combination of the acquired company with an existing participation.

No turnarounds or start-ups

According to our business model, we do not intervene in the operations of our portfolio companies. Accordingly, we never invest in turnaround situations or startups. Also Minority interests do not suit us. Furthermore we do not acquire any companies in the arms, luxury food or gambling industries. In addition, we are not planning any acquisitions in connection with the extraction of fossil fuels.

complete acquisition profile