Since 1995 we have been demonstrating with INDUS how the small and medium-sized enterprise sector and capital market listings can go hand-in-hand. We combine our shareholders’ capital with successful business models designed for the long term. Through active strategic support we provide hidden champions in the SME sector with a platform on which to develop their businesses autonomously.

We have been successful with INDUS because our companies have been successful in their markets. Our shareholders participate in this success through regular dividends and value appreciation.

What makes INDUS shares attractive

Our portfolio…

…is focused on technology-oriented industrial companies in the SME sector of the German speaking countriese sector.

…is diversified and concentrated on clearly defined future fields

…is actively developed further, growing profitably, and enables regular payment of dividends

…creates access to an attractive asset class that cannot be invested in directly through the capital market

…reflects our long-term, sustainable corporate strategy

…maintains and develops the life’s work of SME entrepreneurs

Share performance

Share data

| in EUR | 2023* | 2022* | 2021** | 2020 | 2019 |

|---|---|---|---|---|---|

| Average number of shares | 26,895,559 | 26,895,559 | 26,322,863 | 24,450,509 | 24,450,509 |

| Market capitalization* (in EUR million) | 601.1 | 590.4 | 880.8 | 784.9 | 949.9 |

| Final closing price for the year (XETRA) | 22.35 | 21.95 | 32.75 | 32.10 | 38.85 |

| Highest closing price for the year (XETRA) | 27.40 | 34.35 | 37.30 | 40.45 | 47.45 |

| Lowest closing price for the year (XETRA) | 18.24 | 17.44 | 29.40 | 21.40 | 31.45 |

| Earnings per share | 3.10 | 3.04 | 3.68 | -1.10 | 2.43 |

| Cash flow per share | 8.09 | 4.33 | 6.01 | 6.35 | 6.02 |

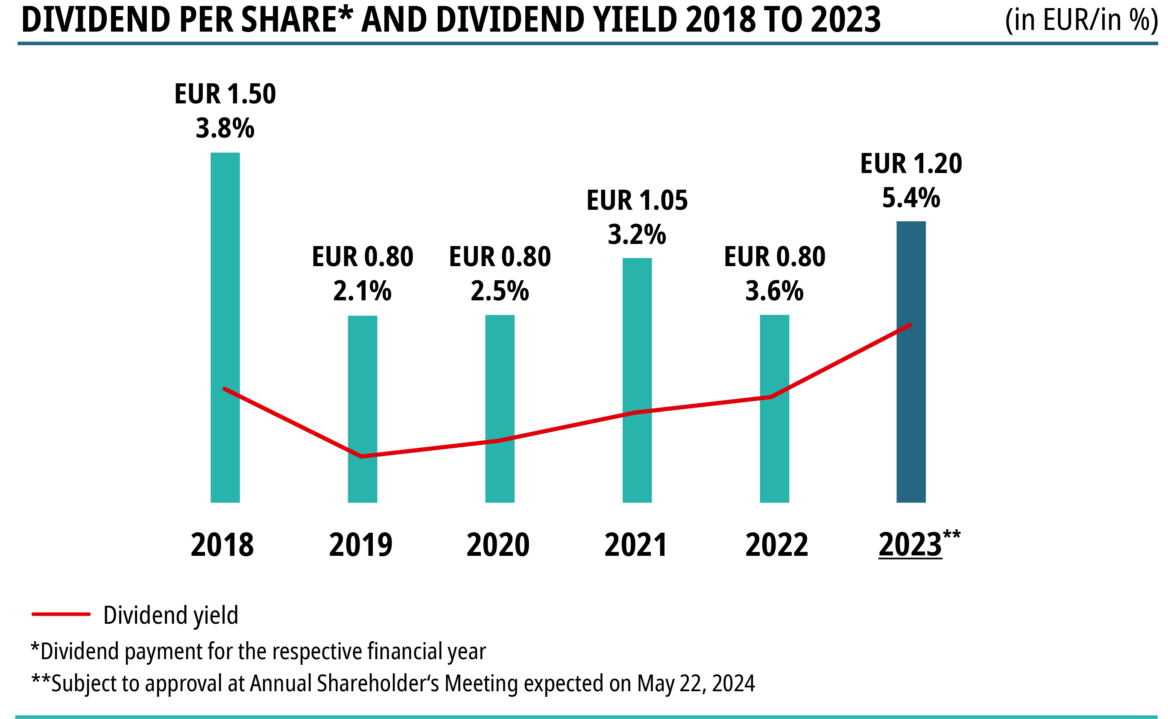

| Dividend per share | 1.20 | 0.80 | 1.05 | 0.80 | 0.80 |

| Dividend yield (in %) | 5.4 | 3.6 | 3.2 | 2.5 | 2.1 |

| Dividend payout ratio (in %) | 38.3 | 79.0 | 51.9 | 60.0 | 24.6 |

Dividend

INDUS shareholders participate in company profits through regular dividend distributions. The dividend policy provides that at least 50% of profits are to be reinvested in the company and up to 50% distributed.

Shareholder base of INDUS Holding AG as of 22 May 2024

INDUS has a very stable shareholder base. Our shareholders bolster our long-term corporate strategy. *The German Stock Exchange defines free float as all shares not held by major shareholders (share of share capital of at least 5%). According to this definition, free float amounts to 76.0%. **The total number of shares amounts to 26,895,559. The 1,100,000 of the shares repurchased by the company are not entitled to vote or receive dividends.

Key data

| WKN/ISIN | 620010/DE0006200108 |

| Ticker | INH.DE |

| Share class | Non-par bearer shares |

| Stock exchanges | XETRA, Düsseldorf, Frankfurt (regulated market); Berlin, Hamburg, Hannover, München, Stuttgart |

| Market segment | Prime Standard |

| Indices | SDAX, DAX International Mid 100, DAXsector Financial Services, Daxsubsector Diversified Financial Services, Classic All Share, Prime All Share, CDAX |

| Designated Sponsors | ICF BANK AG , ODDO BHF |

| Subscribed Capital | EUR 69,928,453.64 |

| Authorized Capital 2021 | EUR 34,964,225.52 |

| No. of shares | 26,895,559 |