Our PARKOUR perform strategy program

Challenging economic conditions have characterized our environment for several years now. In this difficult environment, we are pulling out all the stops to achieve our strategic goals.

With the agility of the Mittelstand, we are also focusing on further increasing the entrepreneurial fitness of our portfolio companies in the coming years.

We shape the future with SMEs!

Our strategy parkour:

PARKOUR perform

INDUS offers its shareholders a managed portfolio of attractive, small and medium-sized industrial technology companies. The development of these companies is driven by future-oriented fields which we derive from the megatrends relevant to us. Through two to three first-level acquisitions per year, we continue to develop our portfolio in a consistent and future-oriented manner.

Strengthening thePortfolio Structure

We support our investments in successfully crossing the threshold into the digital industry. In addition to product innovations, we also promote new services, business processes and business models.

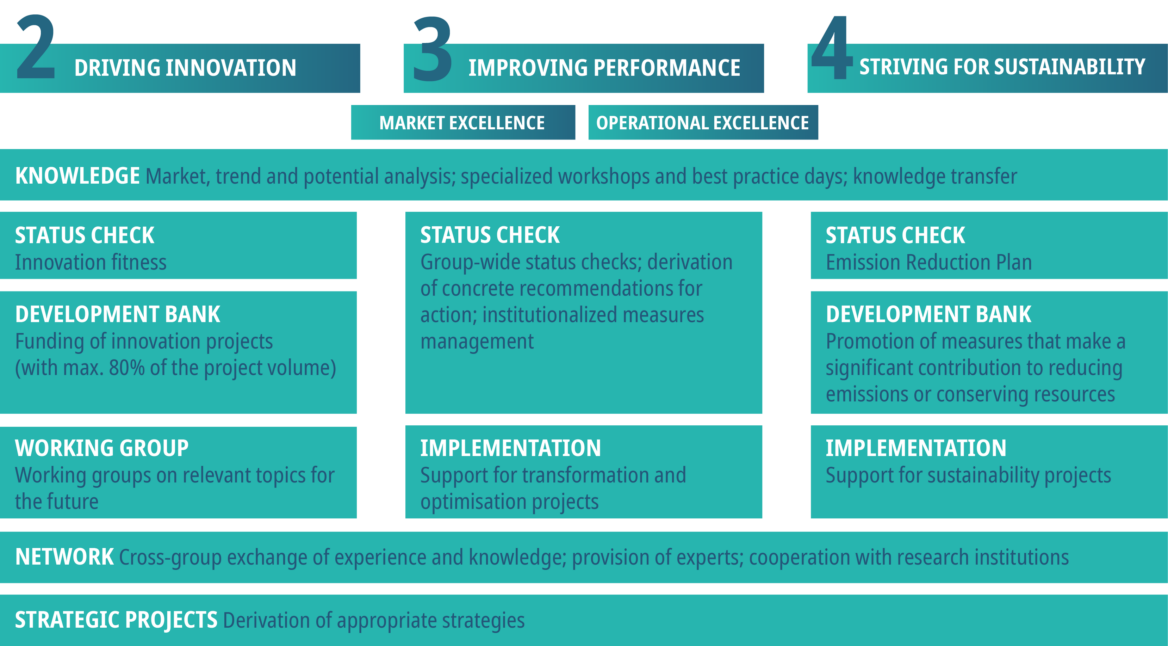

Drivinginnovation

To promote operational and market excellence, we support our investments in the targeted optimization of all value-adding core processes from order creation to order processing.

Improvingperformance

Sustainable business practices generate competitive advantage, increase corporate value and strengthen the corporate culture. We therefore actively support further improvements to the sustainability performance of our portfolio companies.

Striving forSustainability

Megatrends and future fields

Through two to three first-level acquisitions a year, we are systematically developing our portfolio with a view to the future. This strengthens our technological expertise in industrial engineering. This strengthens our technological expertise in industrial engineering. We thus offer our shareholders a managed portfolio of attractive, medium-sized companies.

In our acquisitions, we are led by the relevant topics to INDUS. We derive these from the megatrends of Sustainability, Digitalization, Mobility and Urbanization, and Demographics and Health. We are thus driving the dynamic and future-oriented development of our ENGINEERING, INFRASTRUCTURE and MATERIALS segments.

We support our investments in successfully crossing the threshold into accelerating digitalisation. In addition to product innovations, we support services, business processes and business models. In doing so, we spark innovation via:

- INDUS development bank: We offer financial support of up to 3% of consolidated EBIT for innovation projects in the portfolio companies that develop new technologies and/or new markets.

- Innovation tool box: We share our methodological competence in the development of innovation strategies and tapping into future fields with our portfolio companies.

- Know-how transfer and networking: To promote innovation, we get Group companies in touch with external partners.

- Acquiring innovative companies: We support the acquisition of innovative sub-subsidiaries with younger business models and attractive links to our portfolio companies.

The aim of the “Improving Performance” initiative is to continuously improve business processes by focusing on the actual value creation.

We distinguish between “Market Excellence” and “Operational Excellence”.

The central aim of our Market Excellence focus is to systematically expand and optimize market positioning and market development at our subsidiaries. Activities begin with a status check, which identifies individual potential and the need for action and derives specific recommendations for action.

To promote Operational Excellence, we assist our portfolio companies in effectively optimizing their value-adding core processes from order generation to order processing.

We impart methodological competence and best practice knowledge, offer comprehensive training and further education in the area of lean management, establish network partnerships and accompany the development, planning and implementation of improvement projects in the areas of strategic marketing/sales and production.

Sustainable business practices generate competitive advantage, increase corporate value and strengthen the corporate culture. We therefore actively support further improvements to the sustainability performance of our portfolio companies. We have newly anchored our sustainability strategy as the fourth strategic initiative in our corporate strategy in 2022.

- Economically sustainable conduct ensures future success.

- Social fairness is a fundamental SME principle and encourages cooperation.

- Considering environmental factors prevents subsequent costs and improves process efficiency.

- Compliance with agreements and rules strengthens trust.

Our sustainability magazine SUSTA[IN] is published once a year. Here we provide a direct insight into the sustainability activities of the portfolio companies.

With our newly founded sustainability development bank we will be providing financial support to the portfolio companies from 2022 onwards for projects that aim to conserve resources and reduce emissions. The innovation development bank will also provide funding for sustainable product innovation in the future field of greentech.

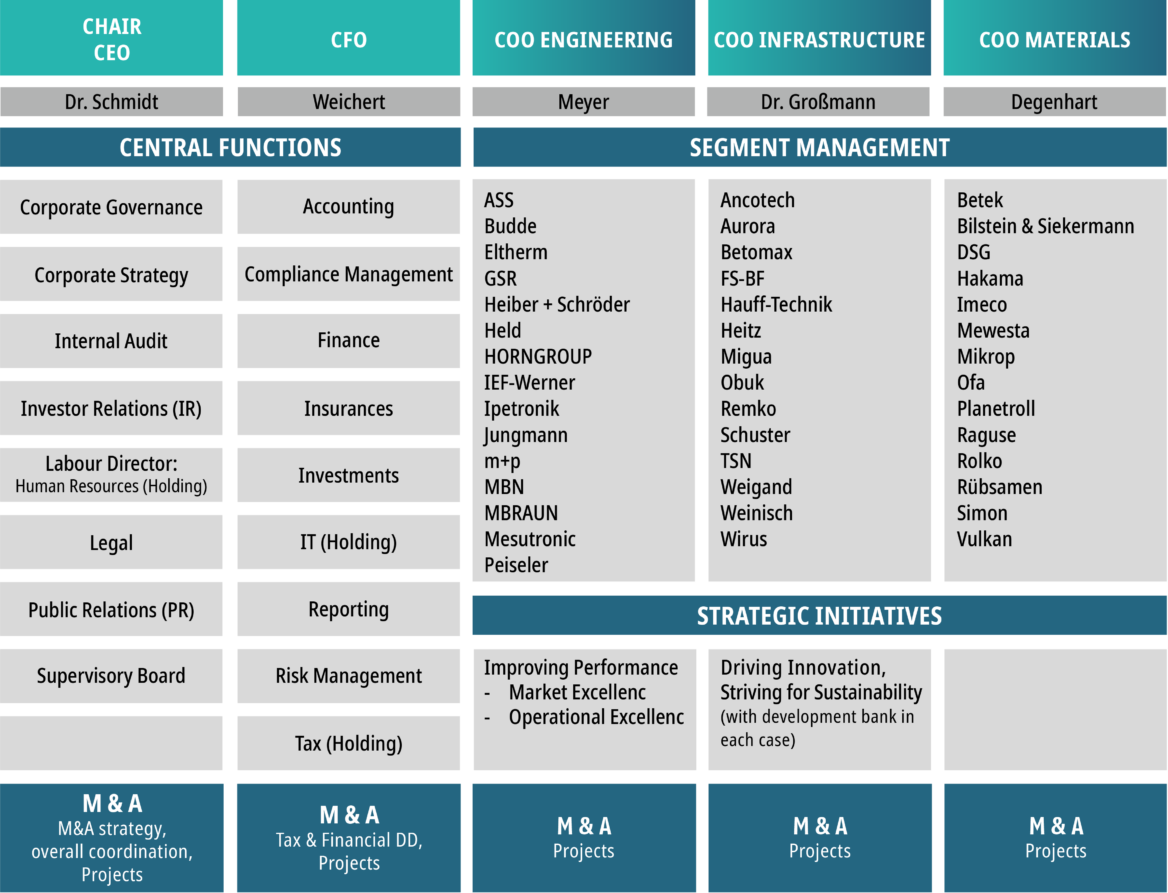

Intensified segment management

With the PARKOUR perform strategy update, there is now a clear allocation of Management Board and segment responsibilities. One Management Board member is responsible for one segment: Axel Meyer for the ENGINEERING segment, Dr. Jörn Großmann for the INFRASTRUCTURE segment and Gudrun Degenhart for the MATERIALS segment. As a specialist, the segment COO maintains close contact with the companies in his area of responsibility. He contributes his expertise in a targeted manner and promotes exchange among the segment companies. He further develops their strategic alignment and ensures their earnings and value development.

The central functions of CEO and CFO remain the responsibility of Dr. Johannes Schmidt and Rudolf Weichert.

Allocation of responsibilites

Our objectives: Profitable growth towards 2025

By maintaining a balanced portfolio structure, we want to grow organically and inorganically through acquisitions at the INDUS Group.